new product launch highlights.

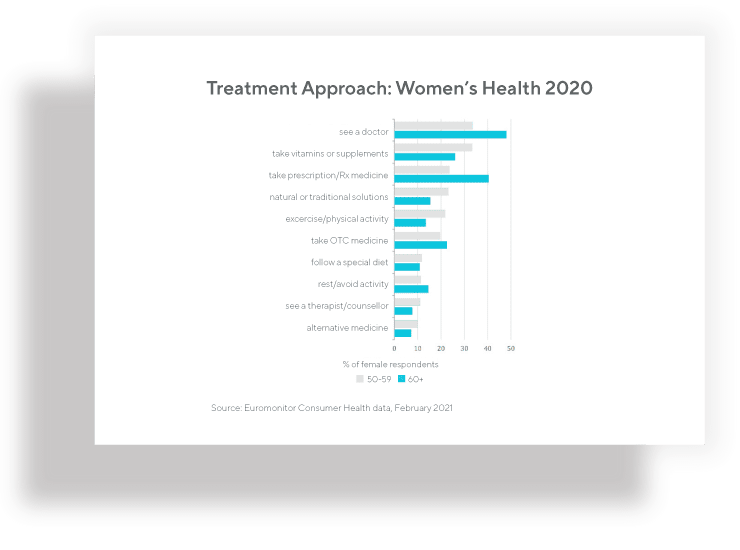

What kind of nutraceutical products are worldwide leaders, such as Bayer, STADA, or Haleon launching and which trends are they addressing? We prepared a collection of recent product launches, interesting due to their recency, their formulations, or the company that launched them, along with an overview of recent food supplement market trends.