Nutraceutical products present an opportunity for pharma companies to introduce a new revenue source relatively quickly. The barrier for entry is low, mainly due to 3 reasons:

- less demanding regulatory requirements

- lower cost of development

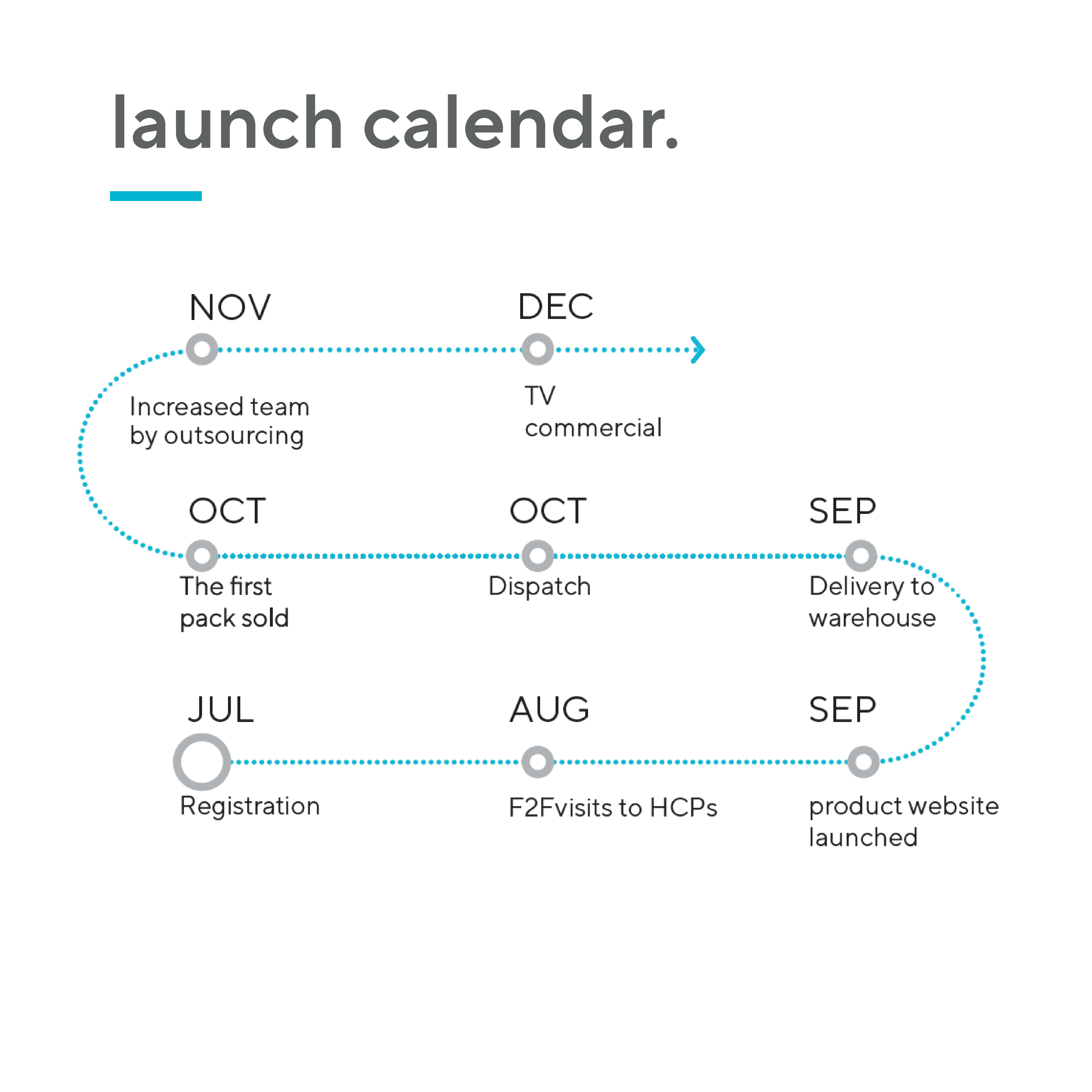

- shorter time to market

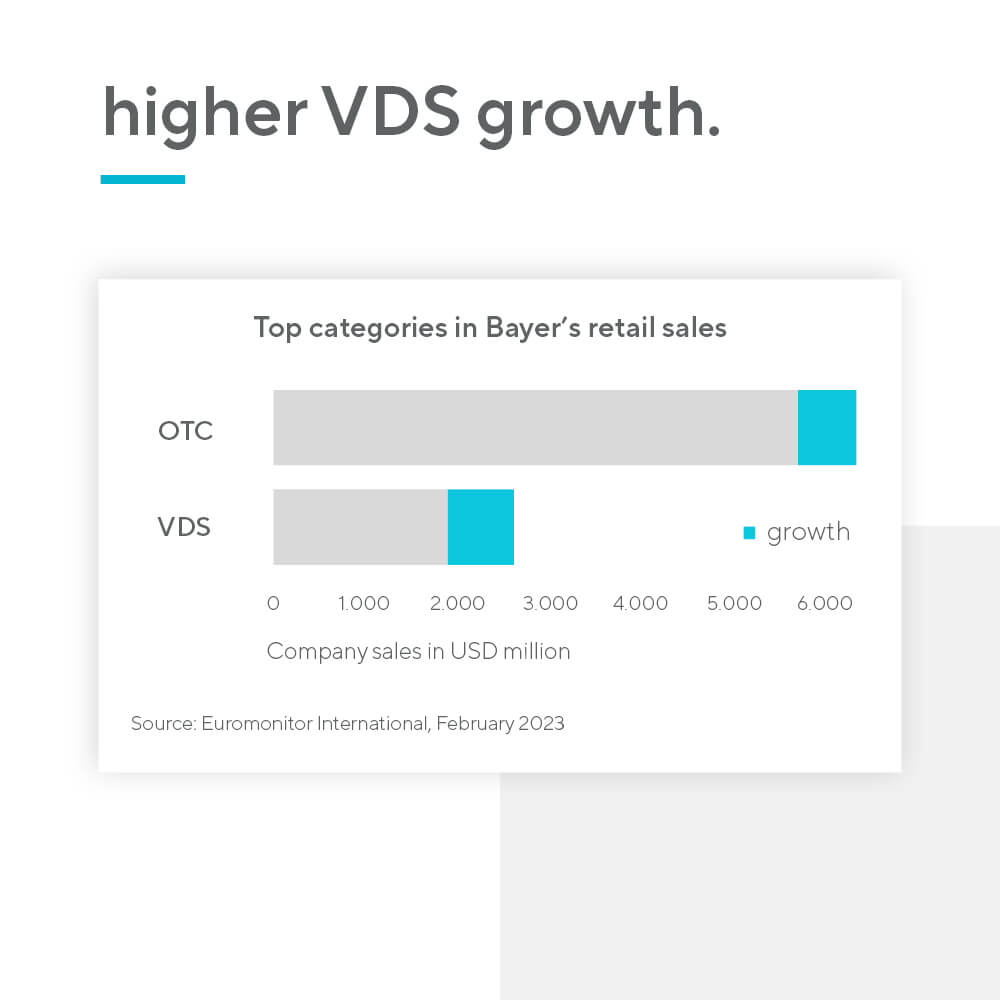

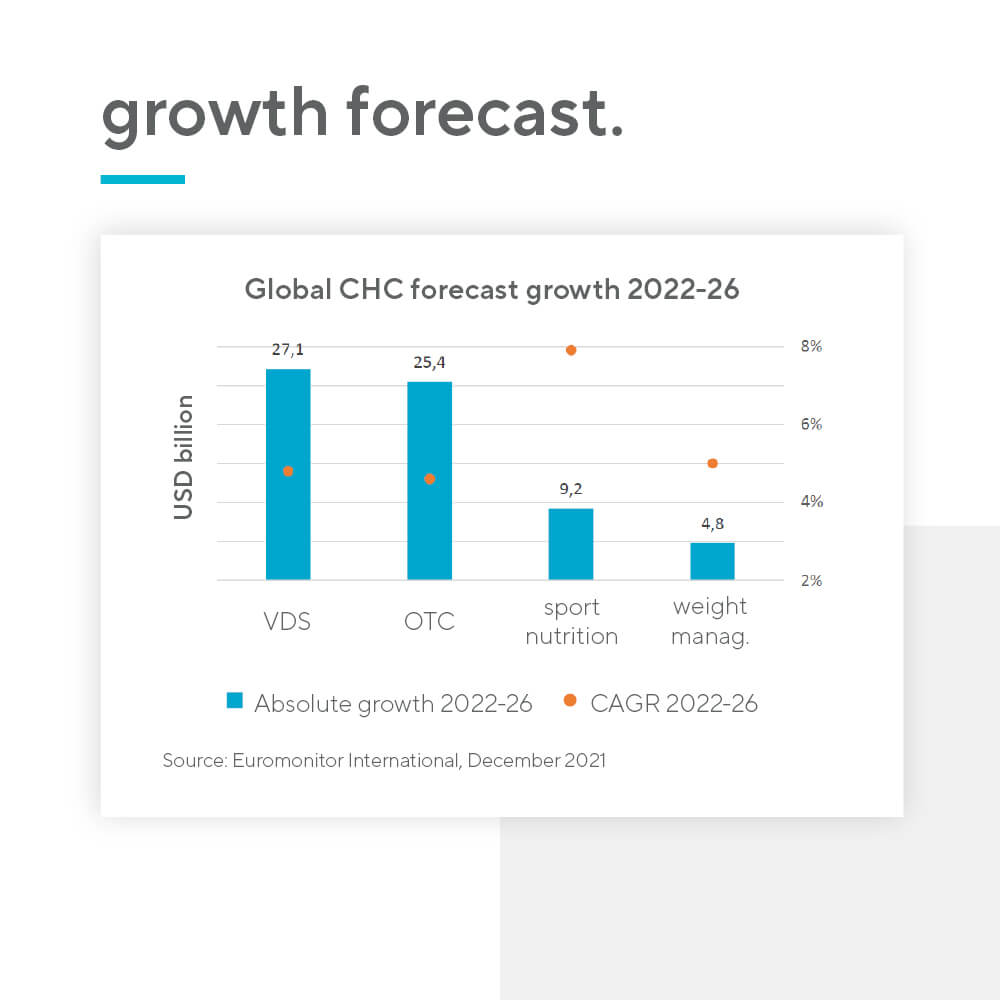

According to IQVIA, the typical time to market for a new indication in OTC drugs is 2-4 years, whereas for nutraceuticals the number is significantly lower – only 1-2 years. Furthermore, vitamins and dietary supplements (VDS) are a high-volume and high-growth category, due to their tapping into the rising preventative health trend. Unsurprisingly, the category is already larger than OTC drugs. There is also no price regulation for nutraceutical products.