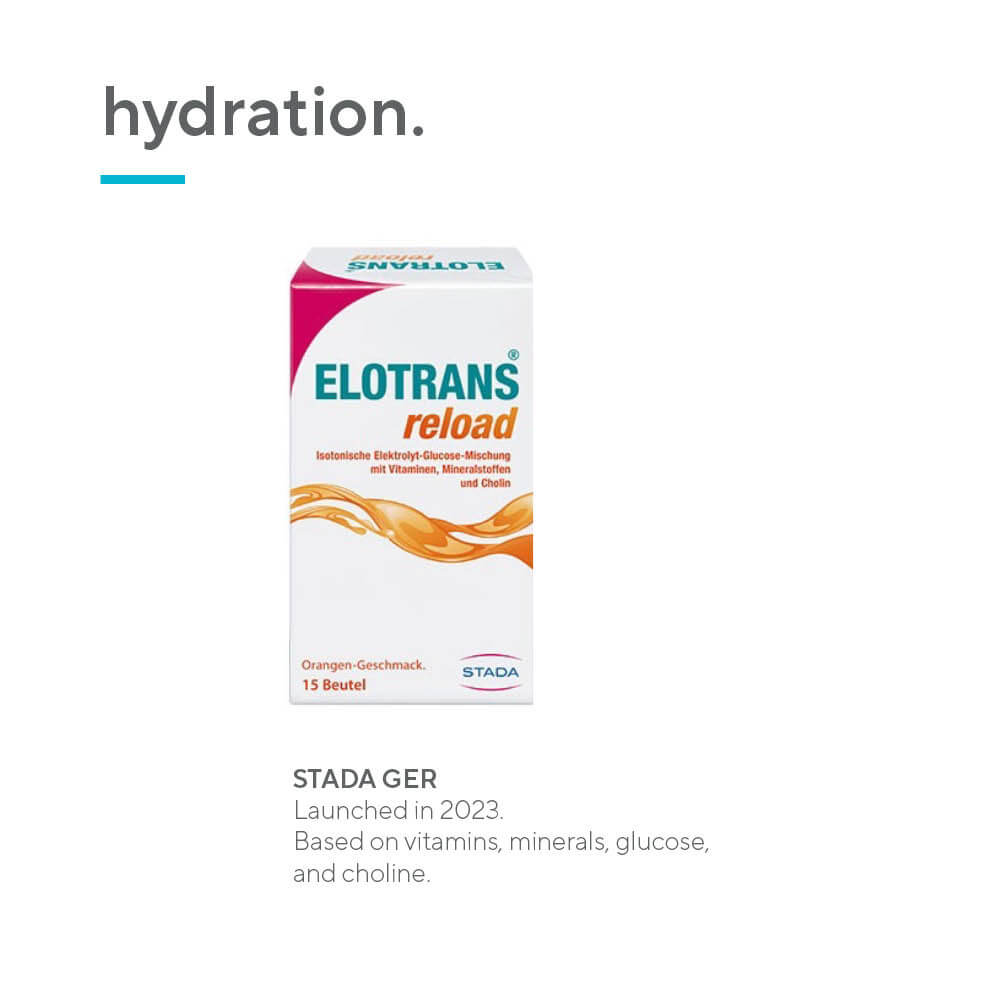

Hydration is moving from only sports nutrition to a more lifestyle product category. Pharma companies, which were traditionally more involved in hydration for diarrhea, are now expanding their portfolios to address other audiences.

An example of this is STADA Germany’s recent launch Elotrans Reload, which is a supplement version of an older medicine product Elotrans, for oral supply of electrolytes and fluids for diarrheal diseases. Elotrans Reload is positioned more towards sports, energy, general use, and exhaustion. Unofficially, the product is also positioned to address hangovers. The product was supported by a youthful marketing campaign which included influencers and weekend sampling in cities and at festivals, targeting younger people and party crowds.